Warren Buffett started managing money in the 1950s, and by the early 1970s, he had taken control of Berkshire Hathaway, the struggling textile business he has since grown into one of the world's largest corporations.

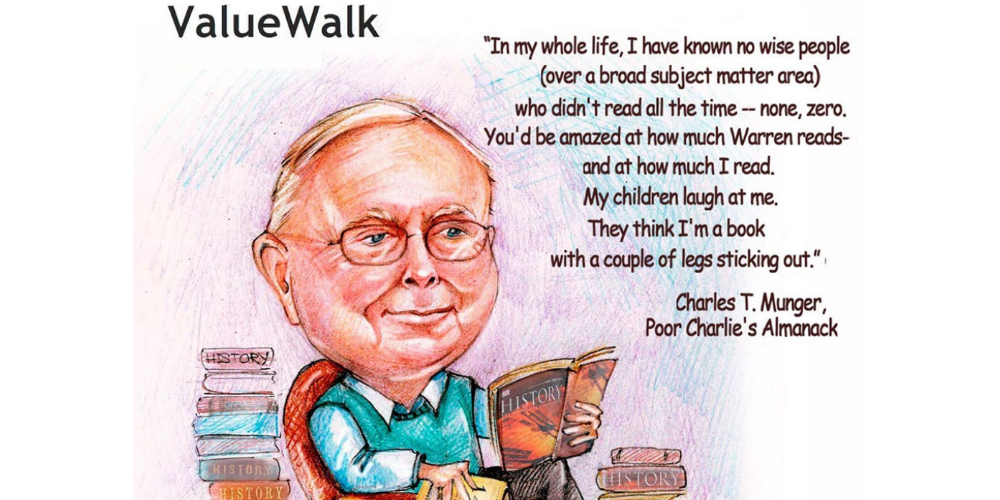

The core of Berkshire has always been its investment portfolio. Until 2010 this was managed solely by Buffett, with occasional input from his right-hand man and fellow Berkshire director, Charlie Munger.

However, in 2010, Buffett started planning for the future and bought on board Todd Combs to help manage Berkshire's vast equity portfolio. Then in 2011, Buffett also asked Ted Weschler to join the conglomerate and help manage its investments.

Q4 2022 hedge fund letters, conferences and more