After a difficult month for the energy sector, the KKR backed BlackGold Opportunity Fund was down 1.3% for August, bringing its year-to-date return to 6.9%. The fund outperformed its benchmark, the Barclays HY Energy Index, which declined 2.5% in August and is up 3.4% for the first eight months of the year.

Defensive positioning outperforms the benchmark

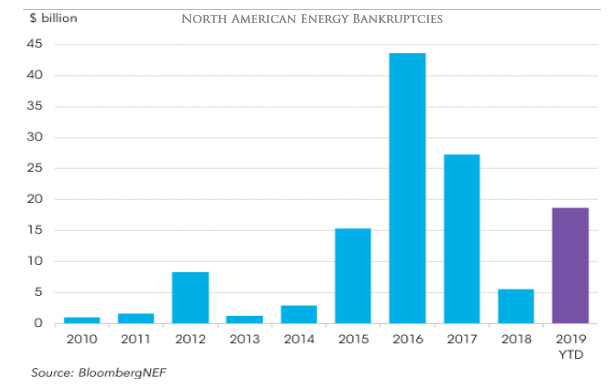

The BlackGold team credits their defensive positioning with midstream credits and higher rated credits for the fund's outperformance against its benchmark. They also said in their August update, which was reviewed by ValueWalk, that the energy market has been in a recession for about the last five years