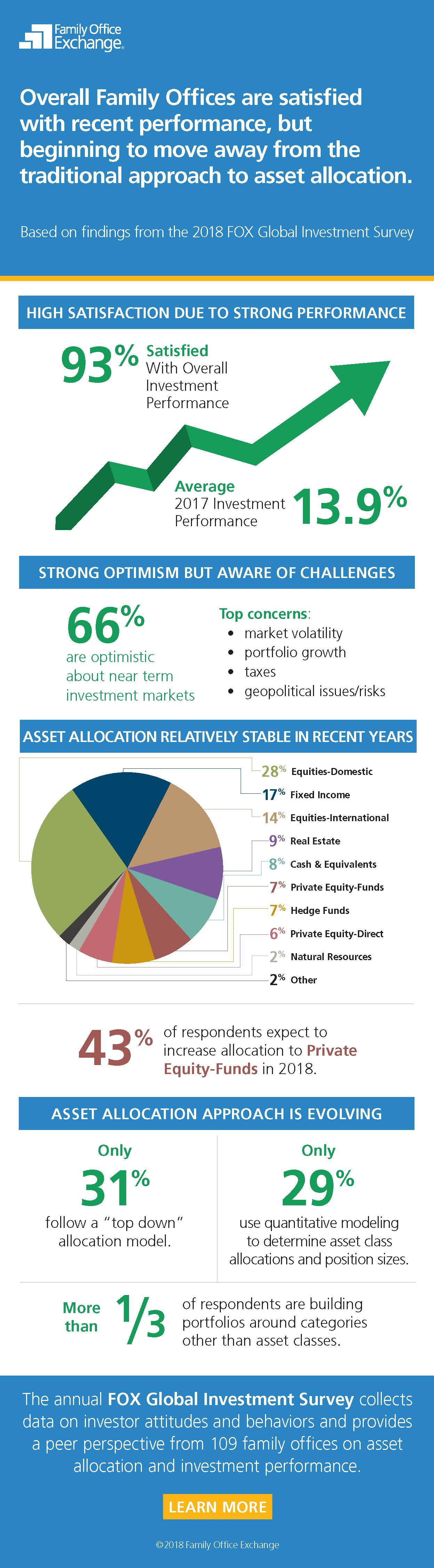

Family offices are making changes in their portfolio management processes, some of which correlate with overall changes in the investment management industry and some of which go against trends. Overall, investors surveyed in the Family Office Exchange Global Investment Survey are pleased with their returns, pointing to both above benchmark returns and a change in allocation trends. The satisfaction comes as allocations to hedge funds have been declining with direct investments in private companies increasing.

While institutions have been growing allocations towards hedge funds and systematic, factor-based investment methods, that hasn’t been the case for family offices.

Hedge funds are most often considered a “bond-like” volatility reduction component in the portfolio...