The Market Rover is all about idea generation. Each week we screen the market, focusing on a different investment theme, in search of interesting investment opportunities. We then highlight a few of our favorites from the list. This report is intended to be a resource for investment idea generation.

Check out our H2 hedge fund letters here.

Last Week:

20 High Yield Bonds Selling-Off, These 3 Are Worth Considering

Last week's Market Rover noted that high yield bonds can be an attractive source of income and capital appreciation. Their prices are often driven more by company-specific idiosyncrasies than by macroeconomic interest rate risks. And depending on your situation, they can be a valuable addition to a diversified investment portfolio. The report highlighted 20 high-yield bonds that are down big, and then reviewed 3 specific bonds that we believe are worth considering.

This Week:

100 High-Yield Preferred Stocks Under $25, These 2 Are Worth Considering

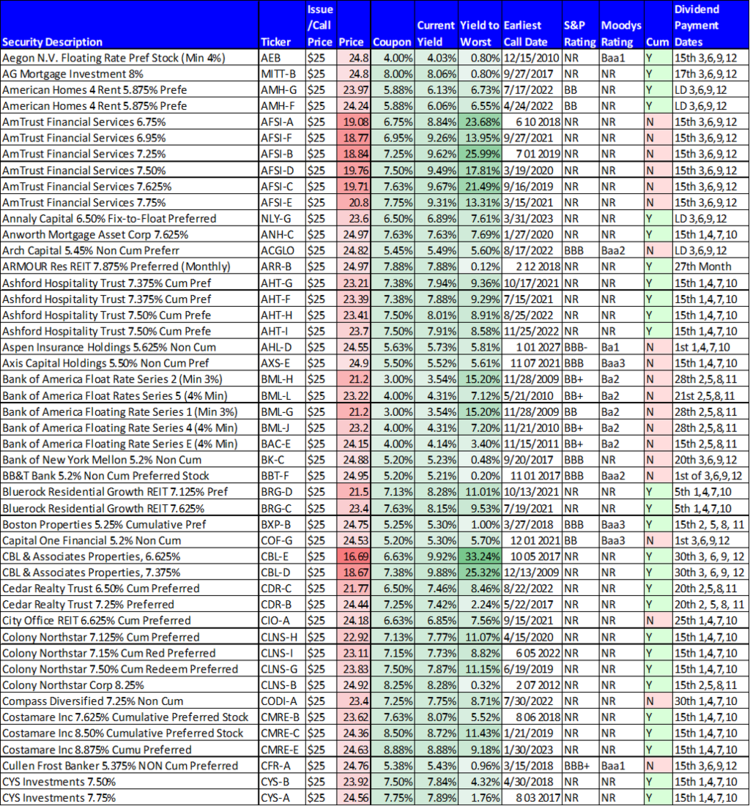

Preferred stocks sit between debt and common equity in the capital structure, and there are a variety of attractive reasons for companies to issue them and for investors to own them. Preferred stocks are often redeemable (after a certain date) by the issuer at $25. And when a preferred stock trades under $25, it can be an indication of perceived risk or a result of interest rate changes. It can also be an indication of attractive value and income. After explaining some of the benefits of preferred stocks, this article shares data on over 100 high-yield preferred stocks that are currently trading under $25, and then we highlight two of them (one preferred stock and one preferred stock closed-end fund) that we consider particularly attractive and worth considering.

Why Preferred Stocks May Be Attractive to Investors

There are a variety of reasons preferred stocks may be attractive to investors. For starters, the dividends are usually higher than the dividends on common stocks - this can be attractive to income-focused investors. Plus, preferred dividends are often cumulative, meaning if a company misses a preferred stock dividend, they are required to make it up later (this is not true for common stock dividends). Another advantage of preferred stocks is that they are often significantly less volatile than common stocks. This can be an extremely attractive quality for lower-risk income-focused investors. Yet another advantage of preferred stocks versus bonds, for example, is that preferred stocks often qualify for lower tax rates than income from bond payments; this can also be a very valuable quality for income-focused investors

Why Preferreds May Be Attractive to Companies Issuing Them

There are a variety of advantages to preferred stocks for the companies that issue them. For example there is no obligation to pay a dividend in a given year if its profits are insufficient; this is a great advantage over issuing debt securities whereby failing to pay constitutes a default. Another advantage of preferred stocks to the company that issues them is that they never mature. Unlike a bond with a set maturity where the company is required to pay them back, with a preferred - the company is never required to pay them back. Yet another advantage of preferreds is that the companies that issue them never have to raise the dividends. Granted companies are never required to raise common stock dividends, but they often do in order to keep the yield competitive relative to the price as it rises over time. On the other hand, preferred stock prices usually hover around their issuing and/or redemption price-usually $25.

And with those characteristics and advantages in mind, here is a list of over 100 high-yield preferred stocks that are currently trading below $25:

100 High-Yield Preferred Stocks Under $25

Two High-Yield Preferreds Worth Considering

1. Tsakos Energy Navigation, Series D Preferred Shares, Yield: 8.8%

Tsakos Energy Navigation (TNP) is a provider of international seaborne crude oil and petroleum product transportation services. Business continues to get better for Tsakos per Monday's earnings release (TNP beat revenue estimates by $27.4 million) following the industry wide challenges in recent years, and we believe investors are incorrectly interpreting and extrapolating poor past performance. Before getting into the details of the business, let's consider the yield on Tsakos' stock (common and preferred).

Tsakos' common shares currently offer an attractive 5.9% dividend yield, and it has multiple series of high-yield preferred shares offering current yields ranging from 8.0% to 9.2%.

We're highlighting the Series D shares in this article (because they trade at under $25), but there are important differences between the preferred shares that investors should be aware of. For starters, they offer different yields and they become redeemable (by Tsakos) at different dates, as shown in the above table.

One of the most commonly overlooked characteristics of these preferred shares is that series B and C shares include a "Failure to Redeem" clause whereby the B shares would breach the conditions of the clause if not redeemed (by Tsakos) by 7/30/19, and the C shares would breach if not redeemed by 10/30/20. Arguably, this makes the B and C series shares "safer" considering the company has a higher incentive to pay them off by the aforementioned dates. And the D and E series offer higher current yields because they don't contain such a clause and they don't become redeemable until later dates. We believe all of the shares are increasingly compelling for income-focused investors, and here's some background on why:

About Tsakos

Tsakos Energy Navigation is a provider of international seaborne crude oil and petroleum product transportation services for international oil companies and refiners. As shown in the following graphic, the company's fleet consists of 65 double-hull vessels totaling 7.2 million deadweight tonnage.

And worth mentioning, Tsakos' fleet is younger than its worldwide peers, especially after considering its recent large capex spend on ships (more on capex later) as shown in the next graphic (note: Tsakos refers to itself as "TEN").

And for color, the following graphic shows some of Tsakos' valuable blue-chip company relationships.

About The Share Price

As the following chart shows, Tsakos, the shipping industry (SEA) and the entire energy sector (XLE) have underperformed the rest of the market (SPY) recently.

Tsakos' recent poor performance has been driven by macroeconomic and company-specific factors, but both are likely about to get significantly better.

For starters, from a macroeconomic standpoint, low oil prices, and supply and demand disruptions (in both energy markets and the shipping industry) have wreaked havoc across the shipping industry with multiple companies dramatically cutting their dividends (e.g. Nordic American Tankers (NAT))) and some shippers filing for bankruptcy altogether, such as Hanjin (despite differing cargos, shipping company prices can trade with a high degree of correlation). However, the cycle may be about to turn upwards considering worldwide oil demand continues to grow, and supply/demand challenges have thinned the herd, with many of those remaining (such as Tsakos) now more operationally efficient (According to management: "We are proud that our G&A expenses must be one of the lowest in our peer group just starting a $1,000 or a little bit above for everything that has to do with running TEN"). For perspective, here is a look at the continuing strength in global oil demand:

For more perspective, here is a look at some of the positive demand considerations from Tsakos' investor presentation:

These positive conditions are positioning Tsakos to benefit from the next upturn in the market cycle, which is expected to begin soon. However, despite the improving outlook, the market continues to extrapolate Tsakos' previous bad performance into the future.

Tsakos’ Recent Performance Looks Worse Than It Really Is

We believe there are three reasons why Tsakos' future prospects are better than they look. First, even though Tsakos missed expectations by two cents when it announced earnings at the end of November, it did beat on revenues (a good thing). It missed earnings because it included $2.5 million of special survey costs that would normally have been incurred at a later stage and have been spread over a longer period (According to management: "We took advantage of the very weak market of the third quarter to bring forward three of our surveys"). But on a go-forward basis, it's good it has gotten this out of the way. Also earnings suffered from refinery outages, and high inventories and OPEC cuts. These negative events are exceptions, not the norm (Tsakos will benefit from not having them every quarter). Further, Tsakos did finally put up a positive earnings number in it's latest earnings announcement on March 12th (and beat revenue expectations).

Secondly, Tsakos just completed a large capital expenditure cycle that positions it for more growth and higher free cash flow in the future. Per the following graphic, the newbuilding vessels are expected to increase revenues by 30%.

With this newbuilding capex largely behind it, a large amount of free cash flow will be generated from increased revenues and simply from not spending so much on capex. This will be helpful to the dividend (more on this later).

Thirdly, many investors are ignoring the expected turn upward in the market cycle (as described in the previous section) and instead they're incorrectly extrapolating recent weak performance into the future.

Tsakos Overall

Tsakos has performed poorly because of market-cycle and company-specific challenges. However, we believe investors are incorrectly interpreting and extrapolating poor past performance, and there are multiple reasons to believe Tsakos will experience significant gains in the future, such as its improved operational efficiency, the completion of a large capex spend (which will increase future free cash flow), and indications the company is about to benefit from an upturn in the market cycle. If you are an income-focused investor, we believe Tsakos' common and preferred shares are worth considering.

2. Nuveen Preferred & Income Securities Fund (JPS):

High-Yield, Double Discounted Price, and Monthly Income Payments

JPS is a closed-end fund, and it invests at least 80% of its net assets in preferred securities. It currently offers a 7.8% yield, and it trades at an unusually large 6.2% discount to its net asset value.

And worth mentioning, preferred securities in general have sold off moderately lately thereby making this fund particularly inexpensive at the moment (more on this later; see "Technical Trading Indicators)." The fund's primary investment objective is to provide high current income.

This fund has a variety of additional attractive qualities. For example, JPS makes monthly distribution payments to its investors (and historically those distributions have consisted of 100% income, 0% capital gains distributed, 0% return of capital). Also attractive, like many closed-end funds, JPS has access to borrowed money at low institutional rates (the leverage ratio is currently 33.3%). Using leverage is common among closed-end funds, and it can prudently help keep income attractive. Further, this fund's management fee is very low for a closed-end fund at only 0.77%.

If you are looking for a steady source of income, this fund offers an attractive 7.8% yield (paid monthly), and it also trades at a double discount (one from the fund's discount to NAV, and two because preferreds have sold off, and sit at a more attractive price). If you're looking for a discounted source for high income, this fund is worth considering.

Technical Trading Indicators

Here is a look at the S&P Preferred Stock Index, and as you can see, it is near the lower end of its historical range (for example it's trading well below its simple 200-day and near its 50-day moving averages).

One significant reason for the sell-off is that the Fed keeps expectations high for more interest rate hikes, and this puts pressure of preferred stocks-particularly high-quality preferreds that can trade more on interest rates than on company specifics, at times. However, certain individual preferred stocks can trade much more heavily on company specifics (such as the price of Tsakos' preferreds in our example above).

For more perspective on technical trading ideas, be sure to check out Jeff Miller's Stock Exchange report from this week: How Do You Handle A Losing Streak?. We help edit this weekly report for Jeff using data provided by his models, and it provides very good perspective on different ways to think about technicals when entering and exiting positions, ranging from near-term mean reversion to powerful momentum opportunities.

More Perspective on the Market

Outside of Blue Harbinger, we manage investment accounts for individuals and institutions. And these in-person interactions often provide very good perspective for the things we write about at Blue Harbinger. For example, this week we put the first dollar to work for a new client, and there is always a clear psychological component to this activity from the client's perspective.

Different investors react differently to market up and downs, and if you don't do a good job understanding needs and setting expectations, you may get a nervous investor pulling his money from an account at the exact wrong time. Josh Brown put this well in a blog post this week:

"Even if a fund is quantitative, rules-based and emotionless in how it operates, the investor flows coming and going into the funds will be as emotionally driven as they are everywhere else."

Hopefully, as investors, we're all making decisions on factors other than emotions. Hopefully, we also all have well-defined investment objectives so we're able to stick to the long-term plan when the market gets bumpy, especially like it did at the beginning of February.

And for reference, if you panicked and went to cash in early February during the market sell-off (it was down more than 10%), it might pain you to know the Nasdaq (QQQ), for example, has since recovered all of those losses and then some; it now sits at its all-time high. It's also up 11.2% year-to-date, and it's up more than 636% since the depths of the financial crisis which was exactly nine years ago (the S&P (SPY) is up over 392% during the same period).

Conclusion

If you have clearly defined investment objectives, high-yield preferred stocks may be part of your plan. In addition to big attractive dividend payments, they can also offer lower volatility and more safety than common stocks. We've included over 100 examples of high-yield preferred stocks trading at under $25 in this article, and we hope you are able to identify a few interesting opportunities from the list. Additionally, for your consideration, we've highlighted two specific opportunities in this article (TNP-D and JPS) that we believe are particularly attractive and worth considering.

Article by Blue Harbinger