Markets & Macro

Markets & Macro

News

Stay on top of the latest hedge fund news with Hedge Fund Alpha! The investment world is always in motion, so it’s never been more important for investors to stay informed on what hedge funds are doing. We bring you timely, accurate reporting on top hedge funds like ValueAct, Citadel, Greenlight Capital, Third Point, Pabrai Investment Funds and more. Dive into the diverse perspectives presented by Hedge Fund Alpha and go behind the headlines here. Hedge Fund Alpha is your go-to source of hedge fund news. From breaking news to developing stories, we have our fingers on the pulse of the hedge fund community and investment universe. Check out all the top headlines here with Hedge Fund Alpha.

Markets & Macro

Markets & Macro

Press Releases

Press Releases

RPD Fund Management Discloses 11.9% Stake In Domo Inc. (DOMO)

Markets & Macro

Markets & Macro

Bank Of Japan Monetary Policy Decision – Amova Asset Management

Hedge Fund News

Hedge Fund News

HSBC Hedge Fund Rankings: After Strong 2025, Equitile’s Resilience Fund Surges to 10%

Press Releases

Press Releases

2026 Outlook: Why Asia-Pacific Is The Next Frontier For Private Credit

Markets & Macro

Markets & Macro

Europe Smashes US ETF Market Growth By Almost 50% While Active ETFs Surge By Over 86%

Markets & Macro

Markets & Macro

Could Limiting Institutional Buyers Fix Housing Affordability? – LPL Financial

Hedge Fund News

Hedge Fund News

Tiger Global Makes Just Nine New Investments In 2025; Big Gains On ChatGPT And Waymo

Markets & Macro

Markets & Macro

European Tech Investments: December Signals That Defined 2025

Hedge Fund News

Hedge Fund News

Strong Finish To 2025 For Hedge Funds, With Equity Long/short Up 18%

Hedge Fund News

Hedge Fund News

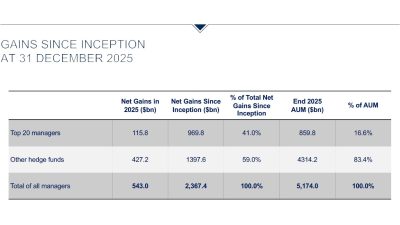

Top 20 Hedge Funds Earn $115B In 2025; TCI Is Leader With $19B Profit

Markets & Macro

Markets & Macro

Secondary Market Transactions In Pre‑IPO Companies: Opportunities And Investor Risks

Markets & Macro

Markets & Macro

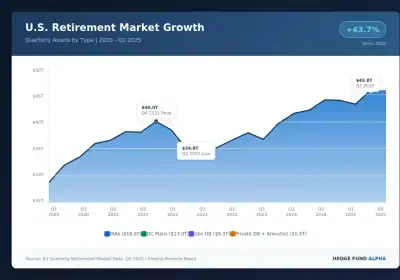

Policy Shifts And Private Assets: The Changing 401(K) Landscape

Value Briefs

Value Briefs

Investing Wisdom From The Oracle Of Omaha: Key Takeaways – LPL

Hedge Fund News

Hedge Fund News

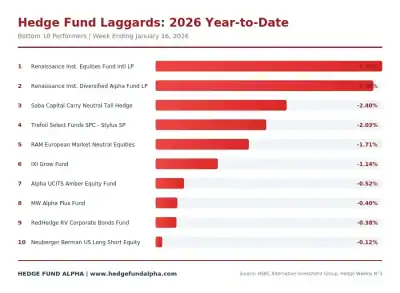

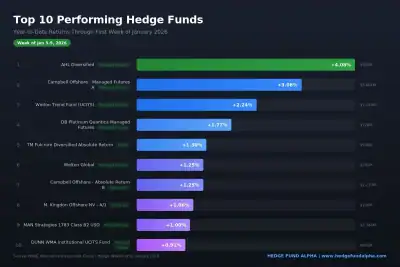

2025 Hedge Fund Winners Confirmed As Systematic Funds Gain Early 2026 Traction

Hedge Fund News

Hedge Fund News

The Volatility Paradox: How New Hedge Fund Managers Can Turn Early Success into Long-Term Success [In-Depth Weekend Read]

Markets & Macro

Markets & Macro

Global Securities Lending Revenue Hits $15B In 2025; These Were The Most Popular Stocks

Press Releases

Press Releases

RPD Fund Management Caps Strong 2025: Fortress Delivers 34 of 35 Positive Months; Opportunity Fund Gains ~40%

Hedge Fund News

Hedge Fund News