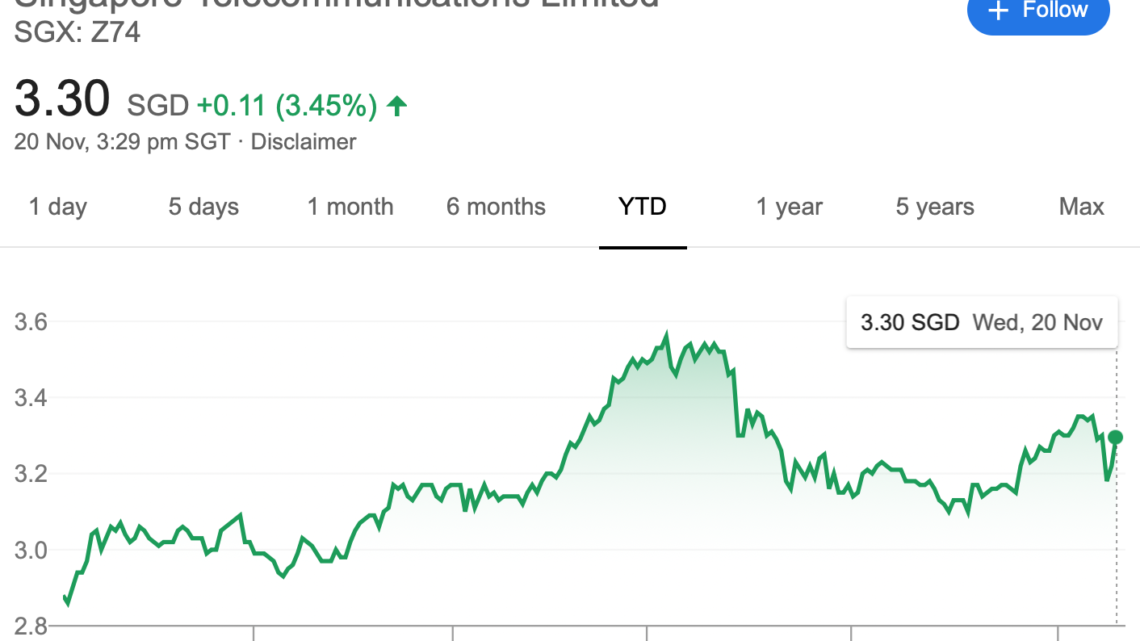

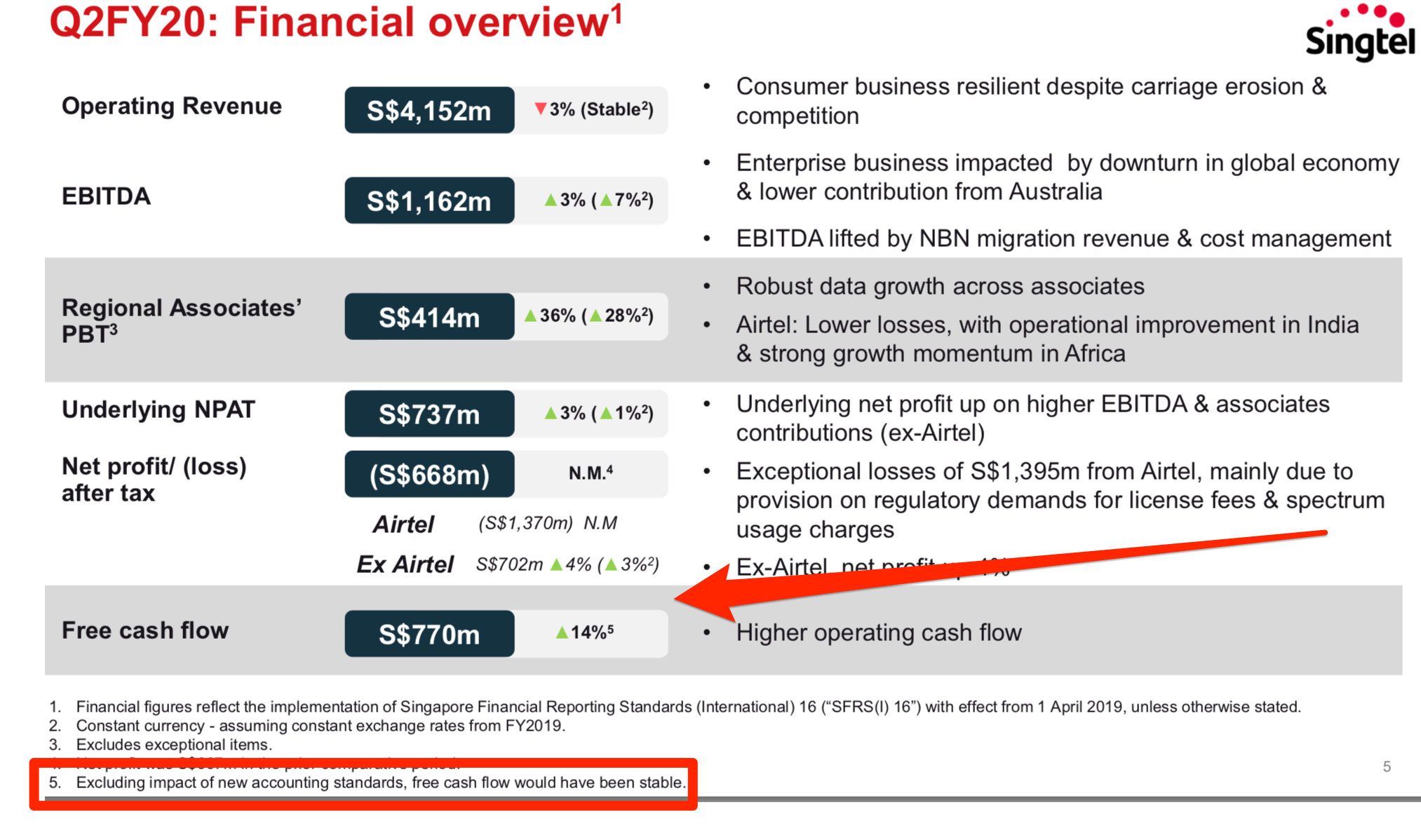

Singtel recently made history by posting a first quarter loss of S$668 million for the second quarter. This was a sharp reversal of a net profit of S$667 million in the same quarter last year.

Q3 2019 hedge fund letters, conferences and more

I’ve written about Singtel and its issues regarding Bharti Airtel before so here are some thoughts about what has happened and whether there are issues regarding its dividend.

What did Singtel post such a big loss for the quarter?

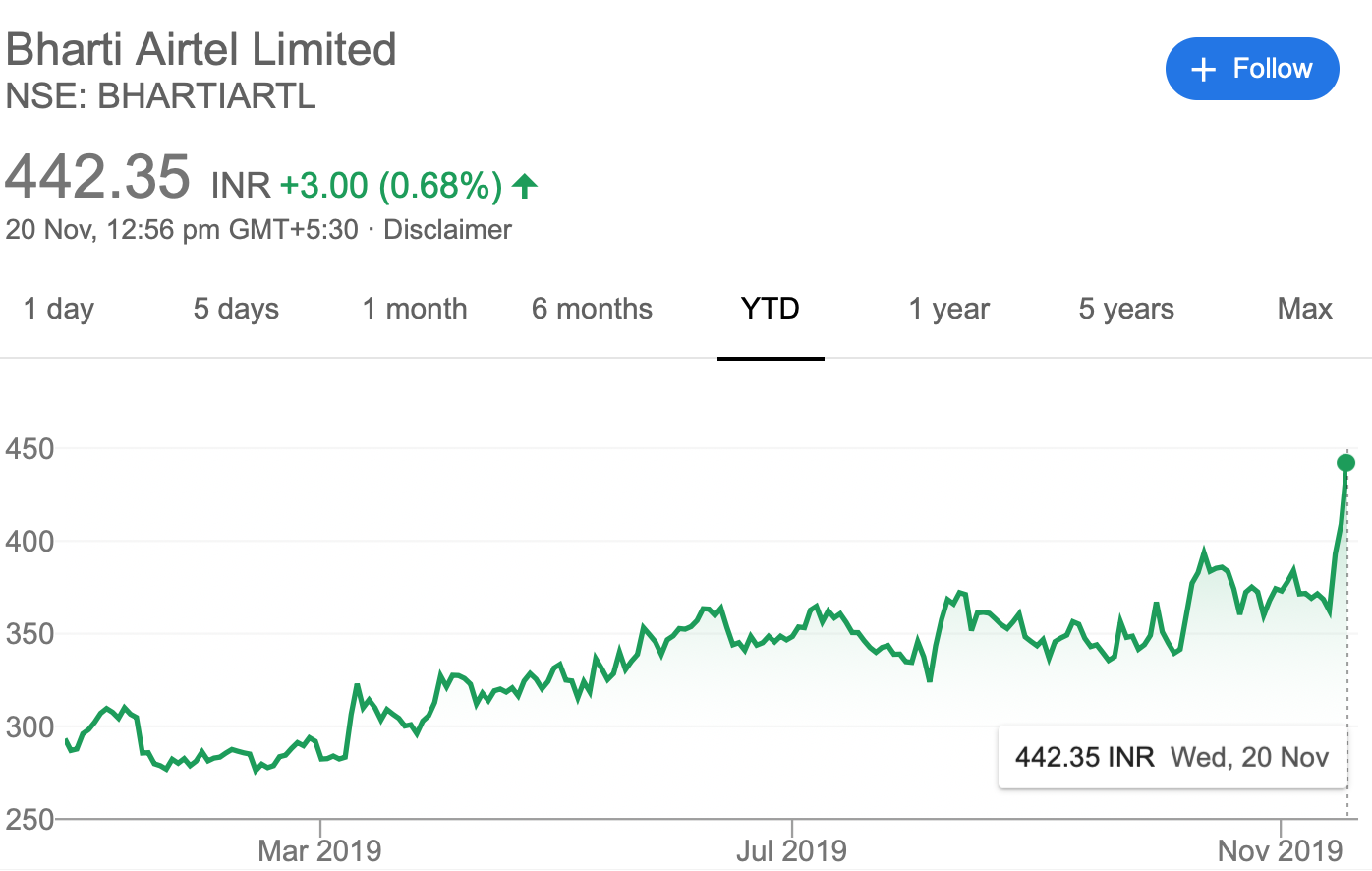

Singtel has a sizable stake in Airtel which was recently hit with a massive court imposed fine.

They had to take a provision regarding this potential outstanding payment.

As Singtel owns 35% of Airtel, it had to take a share of this potential payment and therefore made a proportionate provision.

Does this affect its dividend?

It’s important to note that this didn’t actually affect Singtel’s free cash flow generation for the quarter which was actually stable.

This was a one-off provision in light of the fine.

Does that mean I don’t have to worry about it since its one-off?

Not exactly.

Singtel has pumped in significant amounts of capital into Airtel which was in the midst of a massive price war with Reliance Jio.

According to Credit Suisse, the average revenue per gigabyte fell 95 per cent between 2016 and 2018, pushing operators into precarious financial positions and prompting several to quit altogether.

The industry has consolidated dramatically in the last few years and Airtel is likely to be one of the last players standing when the dust settles.

Fighting a price war isn’t cheap and Airtel has been forced to raise additional capital. Singtel had already subscribed to its rights issues last year to strengthen its balance sheet so news of this penalty is unwelcome news.

In the last issue , Singtel had already renounced about half of its entitlement to GIC which resulted in a dilution of its stake in view of maintaining its balance sheet strength.

Additional investments into Airtel can only be financed by existing cash flow or by leveraging its balance sheet which in my view Singtel does not want to do to maintain its credit rating.

In the case of an additional rights issue in which Singtel does not want to see its stake further diluted, Singtel can other choose to pay out less in dividends (which I think its unlikely at this stage), or choose to take on additional debt on its balance sheet.

On the flip side, there is a silver lining in all this in that the sector is requesting the government to intervene. Extreme financial strain would mean that that the telcos would find it hard to invest further into 5G would be a own-goal for the government.

As significant is the recent news that indicates that the price war maybe at an end with telcos finally planning on increasing prices.

Vodafone Idea, Bharti Surge on Plan to Raise Mobile Tariffs – Link

On a side note, Singtel has stated that barring unforeseen circumstances, it expects to maintain its ordinary dividends at 17.5 cents per share for the financial year ending 31 March 2020.

Article by Richard Tay (Jun Hao), The Asia Report