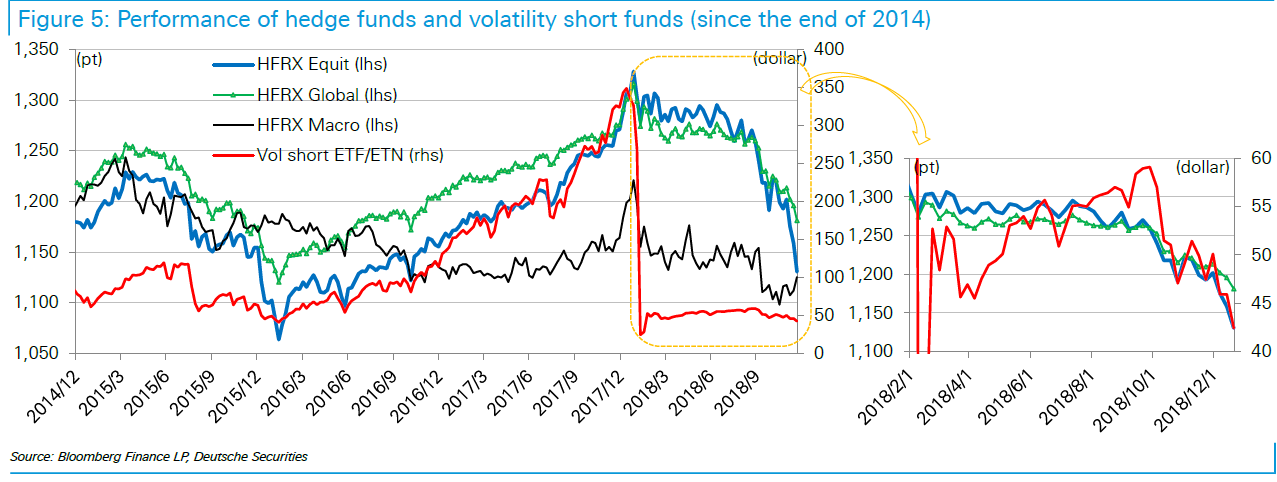

When major investors like hedge funds and public pensions stampede in any one direction, it sends major ripple effects through the financial markets. History tells us that in many cases, such stampedes have served as signals or warnings about what’s right around the corner. A recent report highlighted on a couple of interesting trends involving hedge funds and pensions, and historically, similar trends have signaled a rough ride in the near future. Q3 hedge fund letters, conference, scoops etc Hedge fund redemptions have soared In a report released in the end of December, Deutsche Bank analyst Masao Muraki and team…

These Two Investor Stampedes Are Eerily Similar To Pre-Crisis Events

Michelle deBoer-Jones

Michelle deBoer-Jones is editor-in-chief of Hedge Fund Alpha. She also writes comparative analyses of stocks for TipRanks and runs Providence Writing Services. Previously, she was a television news producer for eight years, producing the morning news programs for NBC affiliates in Evansville, Indiana and Huntsville, Alabama and spending a short time at the CBS affiliate in Huntsville.