Muddy Waters is short Eurofins Scientific SE (EPA:ERF) because the confusion and contradictions inherent in its financials and operations cause us to believe that it is optimized for malfeasance, rather than for conventional business. At best, Eurofins has a parasitic controlling shareholder who has been siphoning money from the company for two decades. Our view, however, is that Eurofins’ financials could contain material overstatements of profits, cash balances, and other asset values.

Eurofins is a company of oddities and contradictions:

- As Eurofins grows larger, it makes smaller acquisitions, with 2019 acquisitions averaging $5.0 million of annual revenue, which declined by 2023 to $3.1 million.1 The vast majority of the acquisitions don’t meet the threshold for disclosure, keeping much of the spending opaque.

- Eurofins denies that it is overly complex, but in 2023, its auditor had to reclassify €682 million of receivables and payables in the 2022 accounts.

- Through 2019, Eurofins claimed that it didn’t seek to buy real estate because doing so “immobilizes capital at low rates of return.” Yet for two decades, Eurofins was seemingly paying far more to Dr. Martin than it would have if it purchased real estate itself.

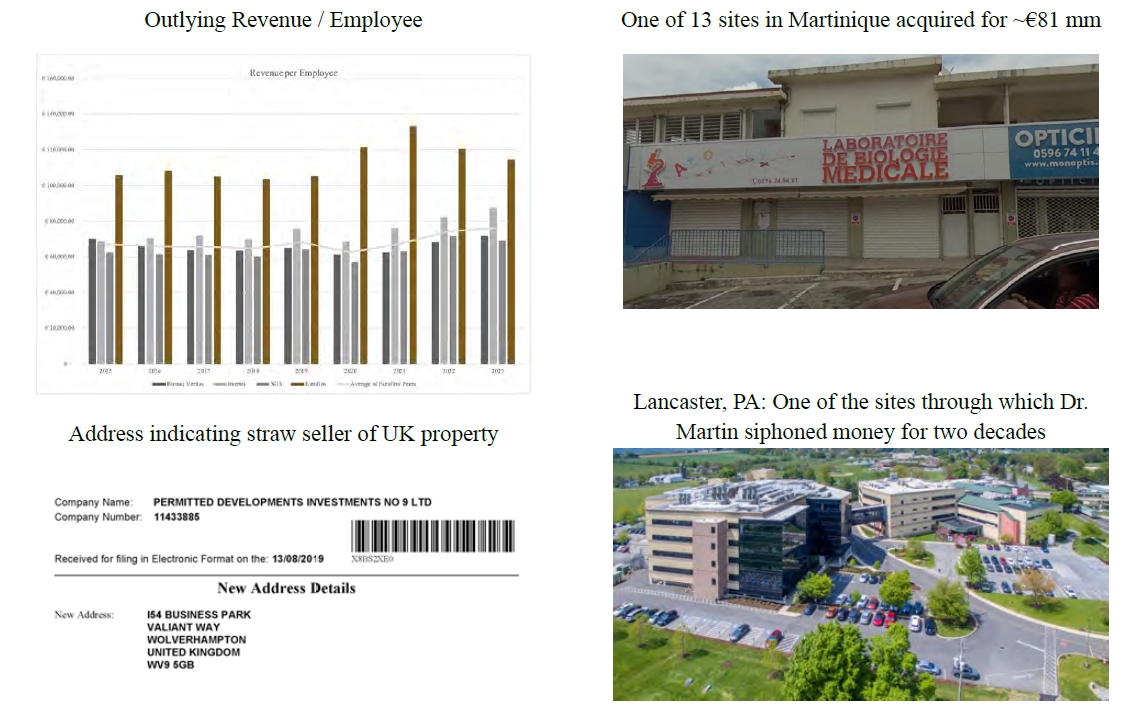

- Eurofins’ revenue per employee has long been a significant outlier in the TIC industry (~50% - 70% higher) while its comps’ metrics were in a tight range.

- Eurofins’ margins, however, generally appear in-line with the industry. Mostly this is due to its compensation per employee also being a significant outlier (~30% higher). However, former employees repeatedly expressed to us that outside of high performing managers of large Business Units, Eurofins is generally nowhere near the top of the industry in pay scale.

- Dr. Martin is well known among former employees for involving himself in seemingly small financial decisions of Business Units. Yet, Eurofins’ cash accounting seems prone to errors, and its much of its internal financial reporting seems prone to manipulation.

- Despite being a seemingly mature business, Eurofins has raised and consumed billions of dollars in recent years, supposedly to fund growth.

In our view, there is an explanation that unifies these, and other, contradictions: Eurofins is optimized for malfeasance. We are unclear how deep the rot goes, but we suspect that it extends to reporting of revenue, profits, cash, and other asset accounts.

For Two Decades, Dr. Martin Has Siphoned Money from Eurofins to Build His Commercial Real Estate Portfolio

We begin the substantive portion of our report by focusing on Dr. Martin’s years of improper and abusive real estate transactions with Eurofins. We believe that Eurofins has far more material problems than the CRE leakage, but due to the straightforward structure of Dr. Martin’s personal holdings, the evidence of real estate malfeasance is quite clear. Eurofins’ suspected financial reporting malfeasance, in contrast, is obscured by Eurofins’ extreme compartmentalization and numerous small denomination transactions. Further, given the blatant nature of these abuses, the facts laid out in this real estate section should answer the threshold question of whether Dr. Martin believes in wealth transfer (as opposed to wealth creation) in the affirmative.

Dr. Martin’s CRE portfolio consists of ~36 CRE properties as of 2023. He appears to have no meaningful tenants other than Eurofins.2 He acquired many of these properties from the sellers of businesses to Eurofins – finding businesses with real estate for Dr. Martin to acquire reportedly was a focus of Eurofins’ M&A. Eurofins supposedly overpaid for operating businesses in order to subsidize Dr. Martin’s real estate purchases. Dr. Martin reportedly rented these properties back to Eurofins at generally above market rates.

Based on the consistently high LTVs that Dr. Martin received on mortgages, we conclude that mortgage lenders viewed his loan applications as amply supported by a combination of low valuations (in our view, often coming from having over-allocated M&A consideration to Eurofins) and high rent cash flows backed by Eurofins’ credit profile. Obtaining an LTV greater than 70% on a specialty industrial or office property in the United States is generally difficult.3 Using either recorded mortgages or estimating using the beginning fixed asset balances and the purchase prices, we estimate that the mean and median LTVs across 22 CRE assets in Dr. Martin’s portfolio exceeds 90%. (It appears that Dr. Martin owns ~36 CRE assets tied to Eurofins as at year-end 2023, but sufficient data was unavailable for the remainder of his portfolio.)

Dr. Martin appears to have been covertly enriching himself by peeling off real estate portions of Eurofins’ M&A transactions as early as 2005. In that year, Eurofins acquired AvTech Labs for an undisclosed amount (see Appendix B). As shown above, soon thereafter, Dr. Martin obtained two mortgages on the property for a combined 163% LTV. In 2011, Eurofins folded AvTech into Lancaster Laboratories, which it had acquired from Thermo Fisher on April 5, 2011 for $200 million. Three months after Eurofins closed on Lancaster Laboratories, Dr. Martin received a significant CRE asset from the transaction. The property registry shows that three months after Eurofins bought Lancaster Laboratories, Dr. Martin bought the property from Eurofins through his direct holding company, Lancaster New Holland Real Estate, Inc. (”LNH”) for $23.75 million. Indicating an abusive transaction, Dr. Martin was then able to obtain a ~85% LTV mortgage on the property.

Read the full report here by Muddy Waters