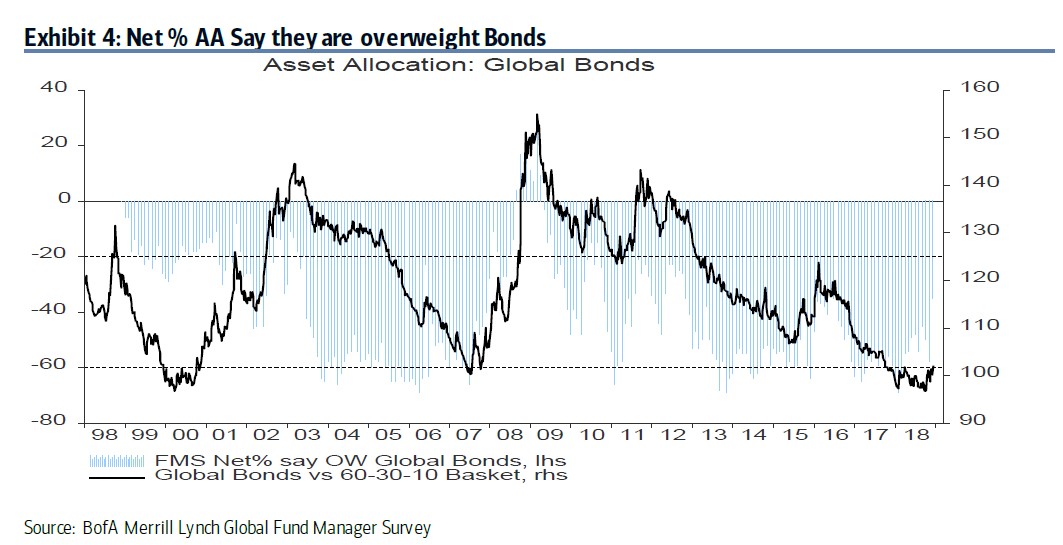

What a difference a year makes, especially when it comes to the financial markets. The market’s current features are almost the total opposite of how the market looked at this time last year. A year, investors saw no reasonable limit to what they wanted to pay for certain assets, but now, a recent survey indicates many have already battened down the hatches and taken up defensive positioning. Q3 hedge fund letters, conference, scoops etc Fund managers are now bearish… a year after extreme bullishness Bank of America Merrill Lynch released the results of its latest Global Fund Manager Survey this…

Fund Managers Are Nearing “Extreme Bearishness”

Michelle deBoer-Jones

Michelle deBoer-Jones is editor-in-chief of Hedge Fund Alpha. She also writes comparative analyses of stocks for TipRanks and runs Providence Writing Services. Previously, she was a television news producer for eight years, producing the morning news programs for NBC affiliates in Evansville, Indiana and Huntsville, Alabama and spending a short time at the CBS affiliate in Huntsville.