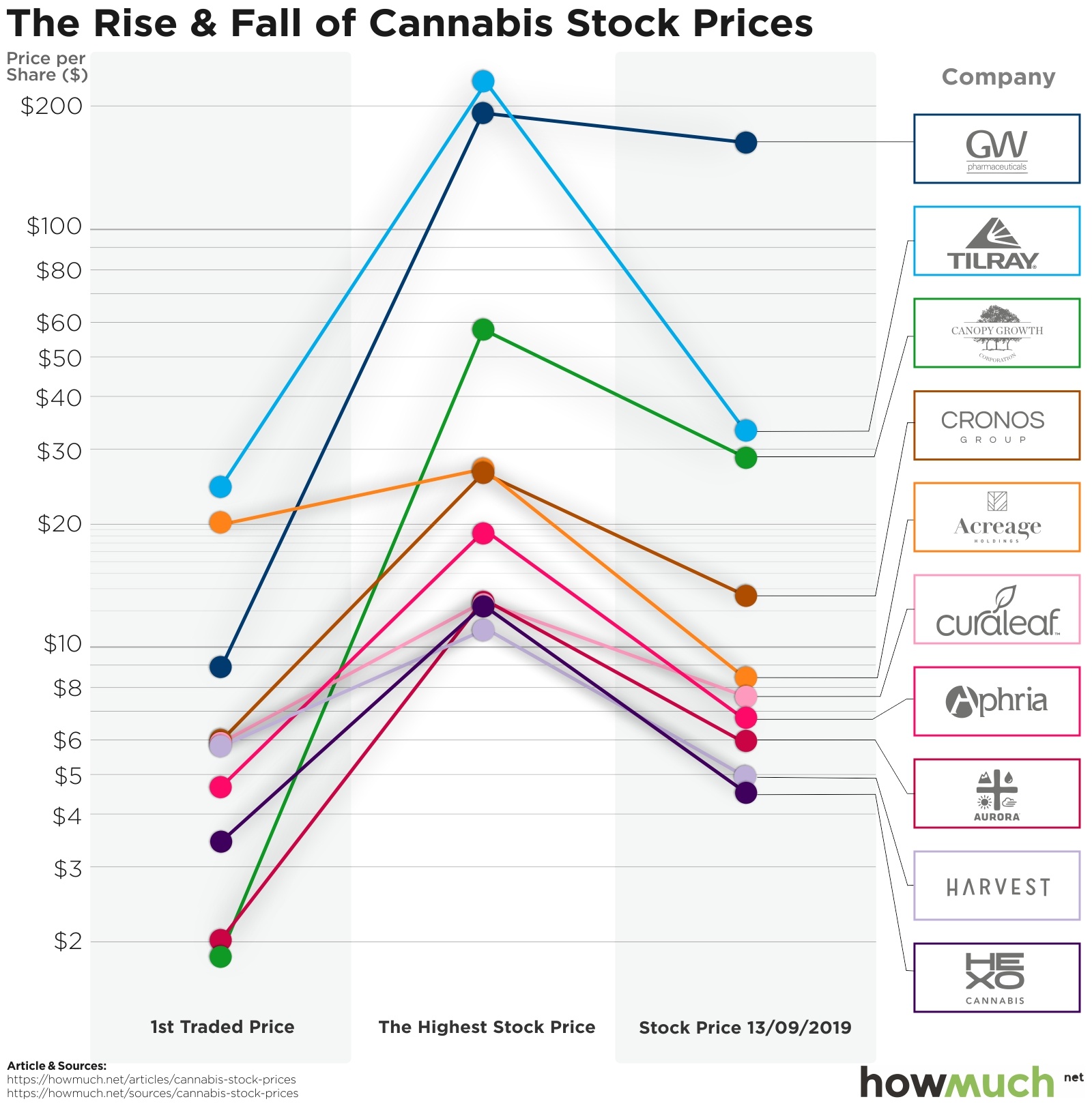

Over the past few years, investors have been eyeing a new type of green — cannabis stocks. Even though only 33 U.S. states and the District of Columbia have legalized marijuana to some degree and there is currently no federal law granting full legalization, American investors are still able to own shares in cannabis-related companies. As more U.S. states are eyeing full marijuana legalization, our new visualization tracks the rise and fall of cannabis stock prices over time.

Q2 hedge fund letters, conference, scoops etc

- Most of these major public cannabis companies are based in Canada, which officially legalized marijuana in 2018.

- All of these stocks increased their share price since IPO, but they have all also decreased from their peak.

- Of the ten major cannabis companies in the graph, only two (Harvest Health & Recreation and Acreage Holdings) have had a negative return for investors so far.

Prices come from Yahoo Finance. Each company in the graph above is represented by a differently colored line, with the company logo. The graph is also divided into three columns; the left column is the price from the first time publicly traded on a “major” stock (TSX, NSYE, Nasdaq; or OTC if not applicable); the middle column is the highest price each stock has reached, and the right column is the stock price as of September 13, 2019. All of these stocks increased their share price since IPO, but they have all also decreased from their peak.

The Largest Cannabis Companies by Current Share Price

- GW Pharmaceuticals:$141.01 share price

2. Tilray: $31.65 share price

3. Canopy Growth: $27.45 share price

4. Cronos Group: $11.54 share price

5. Acreage Holdings: $8.39 share price

6. Curaleaf Holdings: $7.55 share price

7. Aphria: $6.72 share price

8. Aurora Cannabis: $5.94 share price

9. Harvest Health & Recreation: $4.92 share price

10. HEXO: $4.25 share price

Most major public companies related to cannabis are headquartered in Canada, which officially legalized marijuana in October 2018. Of the ten major cannabis companies in the graph, only two (Harvest Health & Recreation and Acreage Holdings) have had a negative return for investors so far. Companies like Canopy Growth have performed particularly well since their debut. In addition, GW Pharmaceuticals has had a return of 1,484.38% and Aurora Cannabis has had a return of 188.28%.

However, some analysts predict that marijuana’s “Big Four” stocks will likely lose money in 2020 due to factors such as aggressive expansion into international markets and issues on the supply side. Vaping-related illnesses are also killing the buzz for entrepreneurs and investors who have been riding high on the marijuana legalization boom. As the legal landscape evolves, so will the share prices and returns of cannabis stocks.

What do you think will be the future of the cannabis industry? Please let us know in the comments.

Data: Table 1.1

Article by HowMuch