Jacob Wolinsky

Wondering what the smart money is up to? These hedge fund investor letters will point you in the right direction. We’ve got investor letters from leading and emerging managers around the globe, so you’ll always be up to date on what the smart money is doing. Some of the top hedge managers whose investor letters we cover include big name funds such as Dan Loeb, David Einhorn, “The Big Short” Greg Lippmann, Jeffrey Ubben’s ValueAct Capital, Marc Azer’s Two Sigma; as well as top emerging managers such as Alluvial Fund, Grey Owl Capital, Arquitos Capital, L1 Capital, Khrom Capital, Black Bear Value Fund, Kernow Asset Management, Gator Capital.

NOTE: We are not affiliated with nor do we endorse any funds listed. Stay on top of the latest in hedge fund commentary below. If you would like to see your fund covered please email us at info(@)hedgefundalpha.com. All inquires are confidential. We do not charge any money to cover funds nor do we accept compensation to be listed. We only cover those funds who we think are interesting or enhance the data (although we do not endorse any fund or investing they do). All emails are confidential and your investors will not know you sent us your letter. While we prefer prominent fund managers and top emerging fund managers we will accept other genres. However, your vehicle must be legally registered with FINRA (and if applicable the SEC) or your local equivalent (like the FCA in the UK_ to be considered. Also see our hedge fund database tool here.

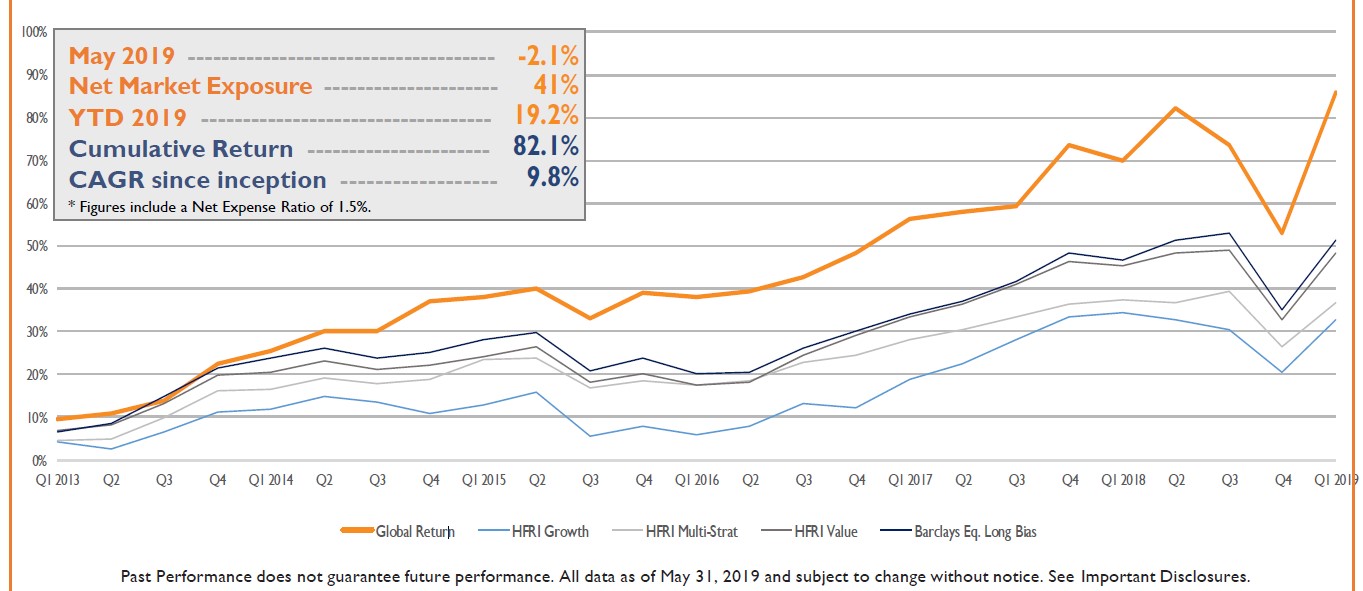

Global Return Asset Management May 2019 Commentary

(UPDATED 6/13 19:06) Q1 2019 TOP Hedge Fund Letters! Stock Pitches, Conferences, Job Openings And More From Sohn, Bass, Einhorn, Loeb, Milken And More

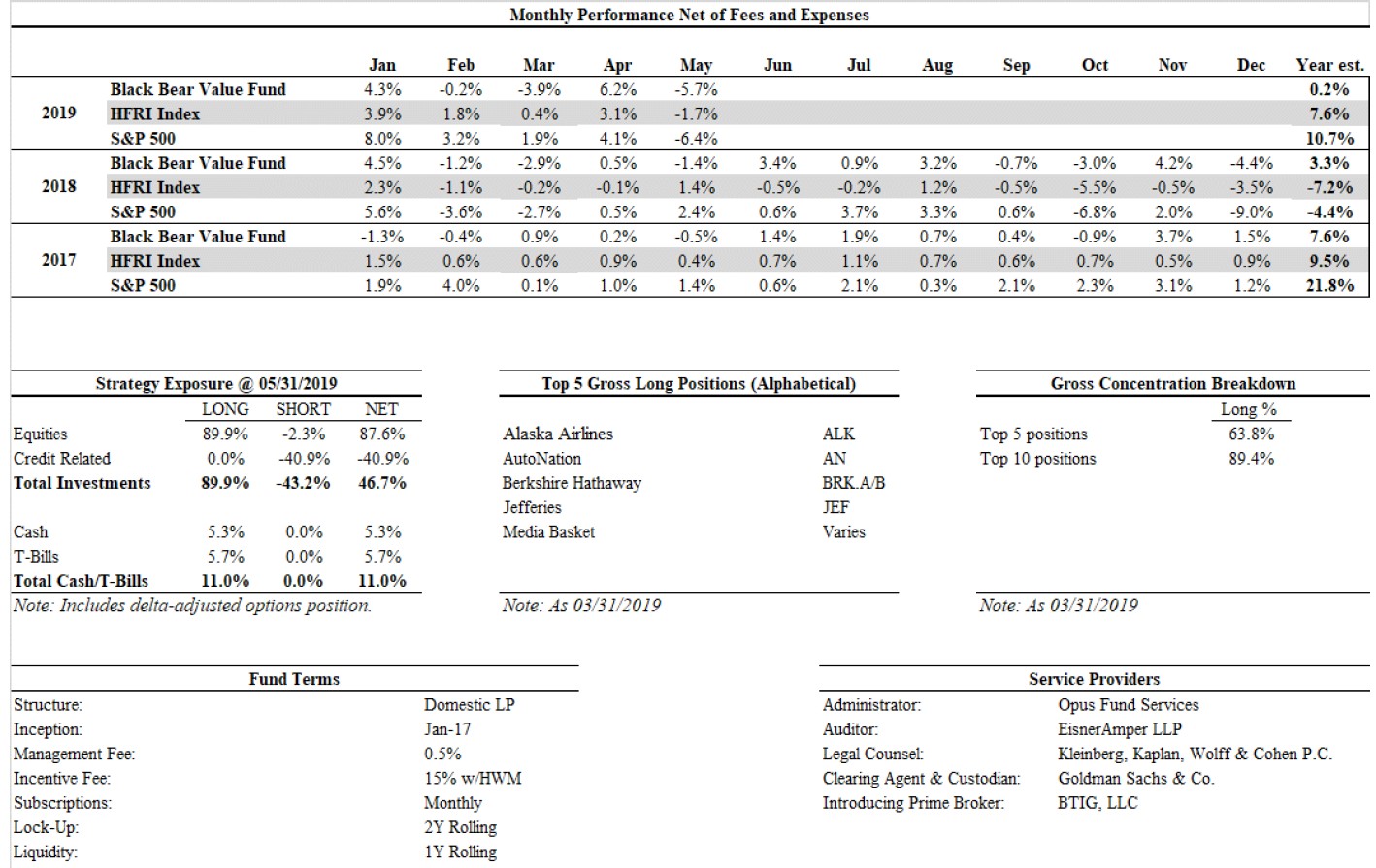

Black Bear Value Fund May 2019 Update

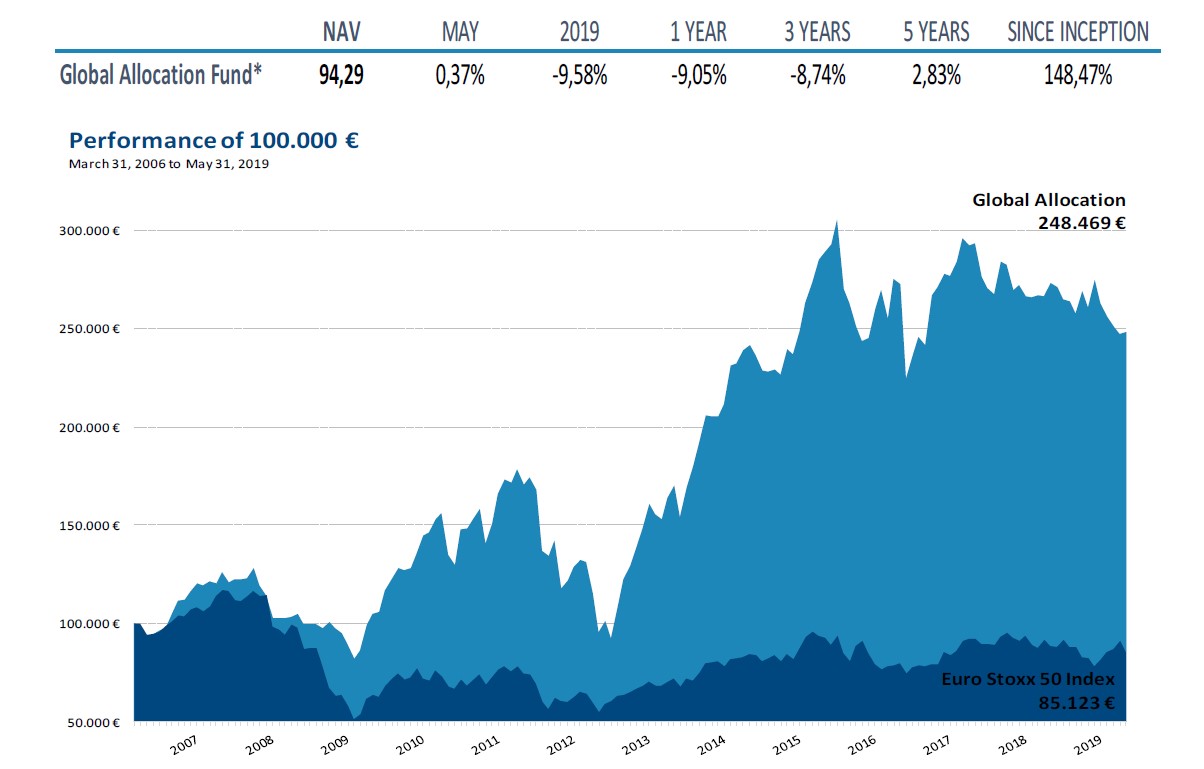

Global Allocation Fund May 2019 Commentary: Mr. Trump knows if the stocks market falls recession that is coming

Steve Nadel: Key Findings From His New Hedge Fund Study

[Notes] Starboard’s Peter Feld: The Deal 2019 Corporate Governance Conference

How Did T. Rowe Price Predict The Market Environment

The Role Of Pension Funds In The Growth Of T. Rowe Price

Notes From TheDeal Corporate Governance Conference 2019: Starboard, Corvex Talk ESG And The New Age of Activism

Steve Nadel: Opportunities In Distressed And Private Credit

T. Rowe Price: Passive Investing Versus Active Investing

Cornelius Bond: Lessons On Learned From Working With T. Rowe Price

Saber Capital 2018 Year-End Review And 1Q19 Update Letter

Allergan: Unlocking Value Through Management Changes – Gabriel Grego of Quintessential Capital Sohn HK Slides

Steve Nadel: Structural Trends In Hedge Funds; Low Management Fee

Steve Nadel: Liquidity Trends And New Hedge Fund Launches

Greenhaven Road Partners Fund 1Q19 Letter: Introducing Desert Lion

Kyle Bass: Chinese Debt Bubble And The Risk Involved In Investing In China